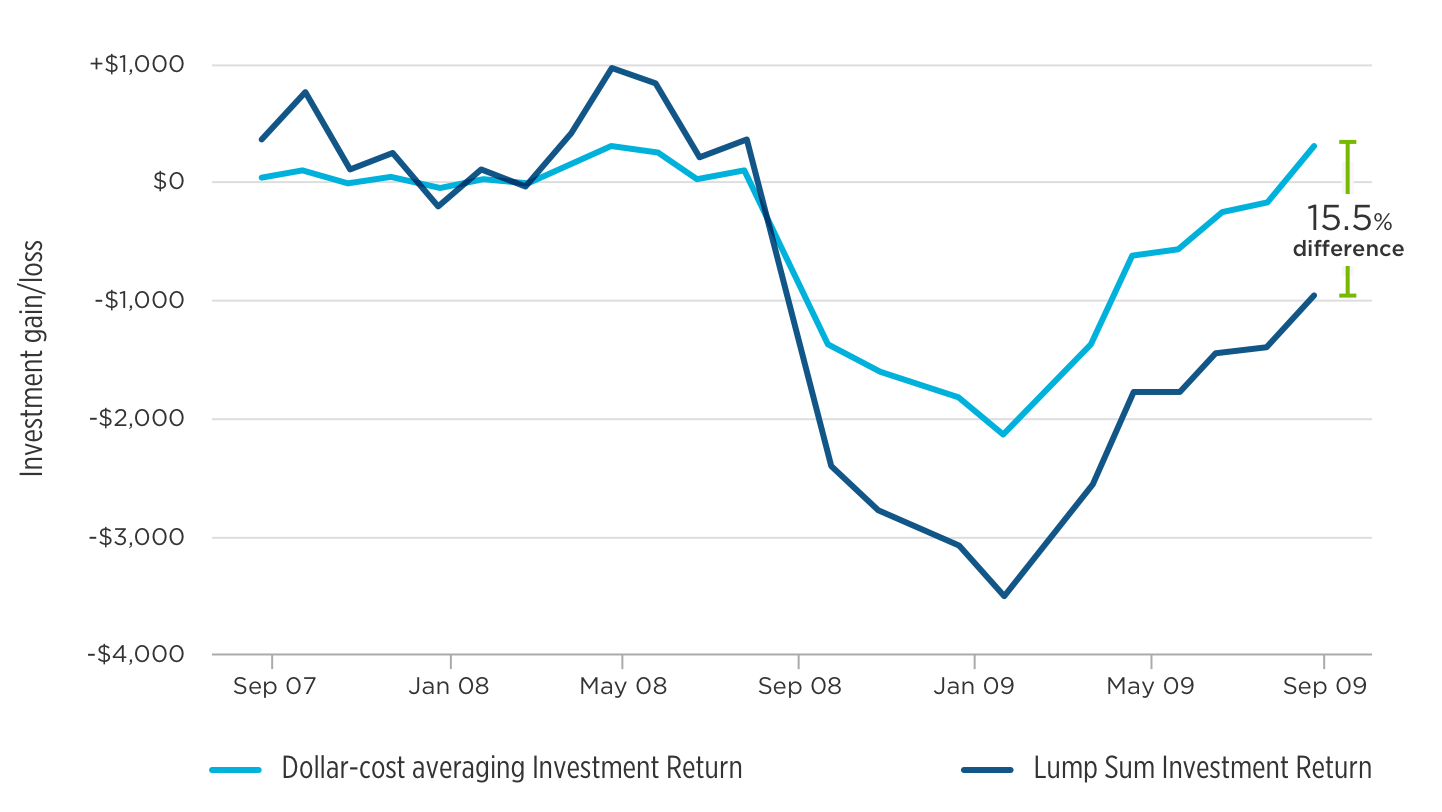

Dollar-cost averaging is an investment technique used to help reduce the risk of timing a single-sum investment. By investing a fixed dollar amount at regular intervals, the “dollar-cost averaging” process helps control the effect of market volatility by smoothing out the average cost per investment unit purchased. Over time, and in certain market conditions, it can result in a lower average price and a higher gain.

One historical time period when dollar-cost averaging may have worked was the market volatility we experienced in 2008. The below graph shows the difference in a hypothetical portfolio using dollar-cost averaging starting on September 1st, 2008, compared to a lump sum investment on that same date. While it’s important to note that dollar-cost averaging doesn’t always produce a higher-end return versus a lump sum, its systematic approach takes the emotional side out of investing and may help investors stay the course.

1. Staying the course in times of turmoil

Source: Dynamic Funds and Morningstar Direct Hypothetical investment in S&P/TSX Composite TR.

Dollar-cost averaging assumptions: Contributions of $400 at the beginning of each month, starting from Sep 1, 2007 to Sep 1, 2009. 25 Contributions totaling $10,000.

2. Diversify

Different asset classes and geographic regions perform differently through different market cycles. That’s why it’s important to avoid keeping your eggs in one basket, as the saying goes. By diversifying your portfolio, you can access the better performers while mitigating risk of being overly concentrated in those that lag.

Performance by Asset Class

Source: Morningstar Research Inc. December 31, 2019

Performance by Country

Source: Morningstar. Annual total returns in Canadian currency as of December 31, 2019. Assumes reinvestment of all income and no transaction costs or taxes. Annual returns compounded monthly. The information is for illustrative purposes only. It is not possible to invest directly in an index.

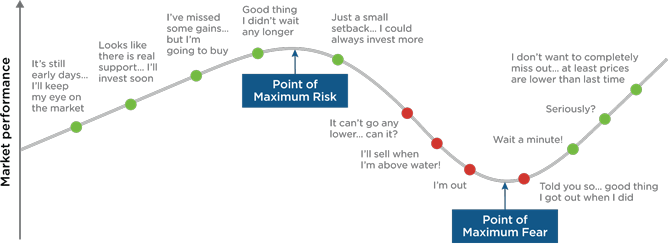

3. Unemotional investing

Avoid letting your emotions guide your investing

Cycle of market emotions

Emotional investing is easy to fall into, but it can wreak havoc on any portfolio. Often, the best and worst times to invest are the very opposite of what our emotions tell us we should be doing.

Overcoming our fears to find growth

Historically, investors have had many reasons to worry about market volatility. Despite the short-term reasons for not investing, maintaining a long-term perspective can work to our advantage; over time, markets recover and grow.

Historical reasons for not investing vs. market growth

Morningstar Direct as of August 31, 2019.

4. Stay invested

Trying to time the ups and downs of the market can leave money sitting on the sidelines when it should be invested. This image shows the impact of missing the best 10, 20 and 30 days on a $10,000 investment in Canadian stocks over the past 10 years. As you can see, staying invested could have led to a better outcome for investors.

$10,000 investment from January 2008 – December 2019

Source: Bloomberg. S&P/TSX Composite Total Return Index, January 1, 2008 to December 31, 2019. It is not possible to invest directly in an index. Assumes reinvestment of all income and no transaction costs or taxes. Value of investment calculated using compounded daily returns. Missing 10, 20 and 30 best days, excludes the top respective return days.

5. Invest with advice

Wealth accumulation: Investing with advice over the long term pays off

Academic research indicates that households that have a financial advisor save at twice the rate compared to those that don’t. What’s more, the same research has shown that over the long term, investors who work with an advisor accumulate almost three times more assets than those who don’t.

Financial advisors help people increase their wealth… and the longer people have advice, the more their investments grow.

Source: The Gamma Factor and the value of Financial Advice, Claude Montmarquette, Natalie Viennot-Briot, 2016

6. Seek Legitimately Active Management

In periods of volatility, active management can pay off because portfolio managers have the ability to select holdings that have potential to:

-

Protect on the downside

-

Provide faster recovery when markets turn around

Why Active Management matters

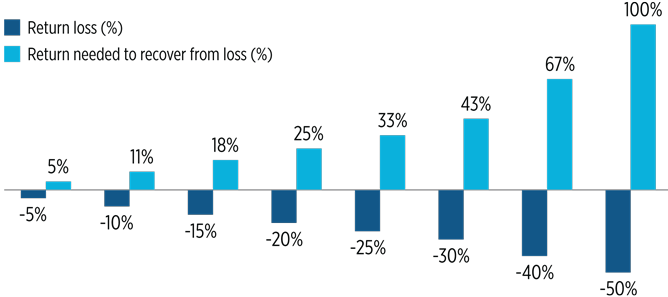

This is important because it often takes a significantly higher return to recover from a loss suffered. For example, a 50% drop in price requires a 100% return just to get back to where you started.